In our last post, we used a party Jollof Rice analogy to help you understand how mutual funds work. Now, we are going to categorize mutual funds according to the instruments they invest in.

There are different investment instruments with different levels of risk. We have low-risk instruments like Treasury Bills and high-risk instrument like Equities (stocks).

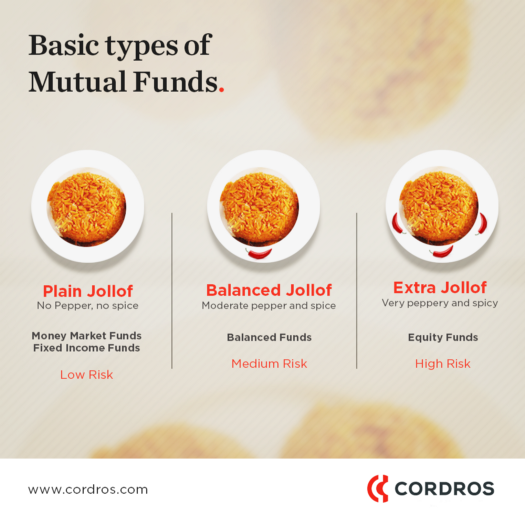

Just like different people have different levels of tolerance for pepper and spices in food, different categories of Mutual Funds have different levels of risk. So, your risk tolerance should guide the Mutual Fund category you invest in.

To further make this simple to understand, we are going to use our Jollof rice analogy to explain and group the 4 basic types of mutual funds into 3 relatable categories:

PLAIN JOLLOF (Not Spicy)

Not being able to take the heat of peppery, spicy Jollof Rice is like having a very low appetite for investment risk. A money market fund or fixed income fund is ideal for people who want safety, regular returns and preservation of their capital. However, because the risk is low, do not expect very high returns.

Money Market Funds invest in high quality but short-term securities such as treasury bills, certificate of deposits, commercial papers etc.

Fixed Income Funds also invest in money market instrument but with longer tenors, returns rate and invests in treasury bills, government bonds etc.

BALANCED JOLLOF (A Little Spicy)

Balanced Funds are for those who want it not too peppery and not too spicy. For individuals with medium risk appetites, balanced funds invest in both high risk and low-risk investment instruments. They are called ‘balanced’ as they are a mix of equities and money market securities which have different performance and risk.

For example, Cordros Milestone Funds 2023 and 2028 invest more in high-risk instruments in the early years in view to get high returns and invest more in low-risk instruments in the later years in view to preserve the returns from high-risk instruments.

EXTRA JOLLOF (Very Spicy)

Liking very peppery Jollof Rice is like having a high tolerance for risk. Equity Mutual Funds are ideal for people with a high tolerance for risk because it invests in stocks with the view to gain higher returns.

Investors who seek higher returns and have high-risk appetites would consider Equity Mutual Funds. Equity Funds are ideal for capital appreciation and not ideal for capital preservation.

Mutual Funds are simple and convenient investment options.

Call 07002673767 or send an email to [email protected] to start.